Auto-Owners Car Insurance Rates vs. Competitors

Auto owners car insurance cost comparison for good drivers

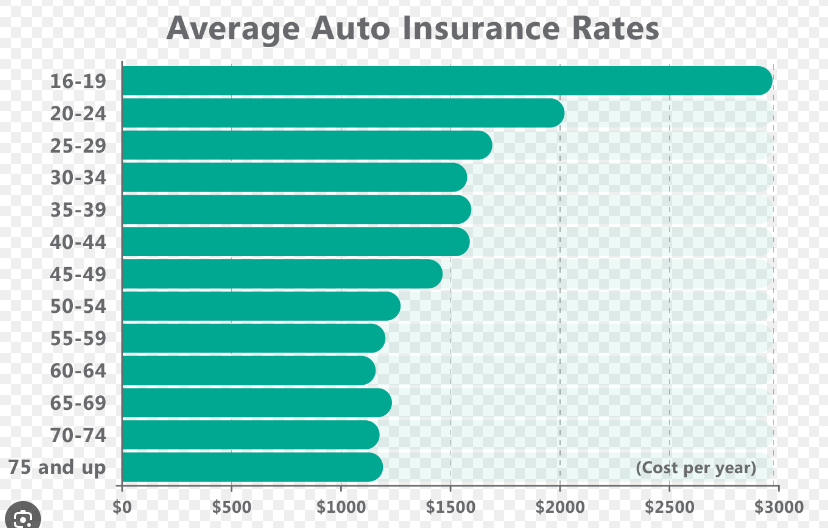

Auto Owners has very competitive car insurance rates for good drivers. Its national average rate for good drivers is more than $500, less than the average of $2,150 a year among the companies we analyzed.

Auto owners car insurance cost comparison for drivers with speeding tickets

Auto owners have competitive rates for drivers with speeding tickets. If you have a ticket on your driving record, it’s smart to shop around for car insurance quotes because of the wide range of rates between companies.

| Company | National average annual cost for drivers with a speeding ticket |

|---|---|

| USAA | $1,709 |

| Geico | $2,098 |

| Auto-Owners | $2,250 |

| State Farm | $2,311 |

| Nationwide | $2,439 |

| Progressive | $2,793 |

| Farmers | $3,014 |

| Allstate | $3,213 |

Auto Insurance Complaints Against Auto Owners

Auto owners have fewer auto insurance complaints than many major insurers, based on complaints made to state insurance departments nationwide. Auto owner complaints are also well below the industry average.

Auto insurance complaints are about claim denials, delays and unsatisfactory settlements.

Auto Owner Grade from Collision Repair Professionals: B+

In a survey of collision repair professionals by the CRASH Network, auto owners received a B+ grade.

The opinion of autobody professionals is worth considering because they see how insurance companies compare in using low-quality repair parts, should insurers encourage the use of repair procedures by car manufacturers. Are and do car insurance companies have claims processes that lead to prompt and speedy processing. Satisfactory claims for customers.