How to Find the Best Insurance for Your Needs 2024

Insurance is a critical aspect of life that many people tend to overlook until it’s too late. The right insurance can protect you from financial ruin and provide peace of mind in the face of unexpected events.

However, with so many types of insurance available, finding the best one for your needs can be overwhelming. Don’t worry! In this blog post, we’ll guide you through the process of finding the perfect insurance coverage by exploring what to look for in an insurance policy, comparing different types of coverage, and understanding their benefits. So buckle up and let’s get started!

What to look for in insurance

When it comes to choosing the right insurance, you may feel like you’re drowning in a sea of options. However, there are some key factors that can help you make an informed decision.

Consider what risks and uncertainties are most relevant to your life. For example, if you have dependents and financial obligations such as mortgage payments or student loans, life insurance is a must-have. Similarly, if you own a vehicle or house, car and home insurance should be top priorities.

Analyze the level of coverage each policy provides. You want to avoid being underinsured for any potential losses but also don’t want to overpay for unnecessary coverages. A balance between adequate coverage and premium payment should be sought after.

Thirdly look out for discounts offered by insurers when purchasing policies in bulk or combining different types of coverage with them.

The goal is not only finding affordable rates but also ensuring that those rates align with your unique needs while providing reliable protection against unexpected events which could cause severe financial harm.

Types of Insurance

When it comes to insurance, there are many different types available. It can be overwhelming trying to navigate through the various options and determine which ones are right for you.

One common type of insurance is health insurance, which helps cover medical expenses such as doctor visits, hospital stays, and prescription medications. This is especially important in countries without universal healthcare coverage.

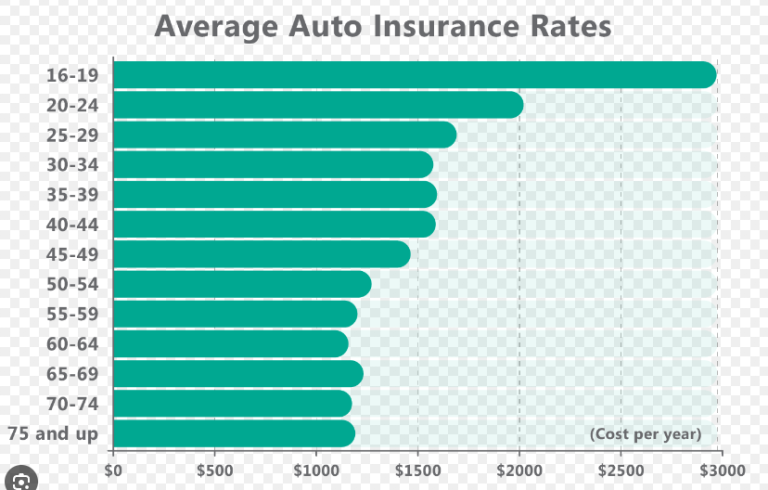

Another type of insurance is auto insurance, which covers damages or injuries caused by a car accident. It’s important to have this kind of coverage not just because it’s required by law in many places but also because accidents can happen at any time.

Homeowners’ or renters’ insurance is another crucial type of coverage that helps protect your property in case of damage or theft. It provides financial assistance for repairs or replacement if something were to happen unexpectedly.

Life insurance ensures that your loved ones will receive financial support after you pass away. This policy can help pay for final expenses and provide ongoing income for dependents left behind.

Knowing the different types of insurance available will help you make informed decisions about what policies are necessary based on your specific needs and circumstances.

How to compare different types of insurance

When you’re choosing insurance, it’s important to compare different options and find the best fit for your needs. But how do you go about comparing different types of insurance? Here are some tips to help:

Consider the coverage offered by each type of insurance. What does it protect against? Does it cover all the risks that concern you?

Next, look at the cost of each option. This includes both premiums and deductibles. You’ll want to find a balance between affordability and adequate coverage.

It’s also important to check out the reputation of each insurer. Do they have good customer reviews and ratings? Are they known for providing quality service?

Another thing to consider is any exclusions or limitations in coverage. Make sure you understand what is and isn’t covered under each policy.

Don’t forget to take into account any additional benefits or perks offered by certain insurers or policies.

By carefully evaluating these factors for each type of insurance that interests you, you can make an informed decision about which option will provide the best protection for your needs while staying within your budget.

What are the benefits of various types of insurance?

Understanding the advantages of various insurance kinds is crucial for financial planning, as insurance plays a significant role in it. By guaranteeing your loved ones will be compensated in the event of your untimely death, life insurance offers peace of mind. This benefit may assist in defraying funeral and other related expenditures.

Health insurance provides financial protection against high medical costs that may result from unanticipated diseases or accidents. It also includes preventative care practises, which are crucial for preserving health and include routine checkups, immunisations, and other procedures.

The benefit of homeowner’s insurance is that it protects one of the biggest investments you will ever make: your house. Homeowners insurance may provide liability coverage in the event that someone is hurt on your property, in addition to covering losses from theft, fire, and natural disasters.

Financial protection against car accidents is offered by auto insurance. It compensates for any injuries caused by drivers or passengers engaged in the collision, as well as repairs or replacement if a vehicle is damaged in an accident.

Disability insurance makes sure you have replacement income in the event that an extended sickness or disability prevents you from working. This kind of coverage aids in providing for your basic needs while you heal from a brief incapacity.

Since every insurance plan offers distinct advantages catered to certain requirements, considering your options carefully will guarantee that you will ultimately be most satisfied with the features.

Conclusion

To sum up, it might be challenging to get the ideal insurance for your requirements, but having both is crucial. Make a list of the things you need and desire from an insurance coverage first. Consider factors including as price, deductibles, policy restrictions, and items that aren’t covered.

Examine the many types of insurance available and contrast policies offered by various providers to choose the best fit for your need. Remember to thoroughly read any agreements or contracts before signing them.

Always keep in mind that having enough insurance can protect you financially when bad things happen. You can find an insurance policy that gives you peace of mind and fits your budget if you think about it carefully and do your study.

Now it’s time to do something! Take the time to find the best insurance for your needs right now. That way, you can rest easy knowing you’re covered no matter what.