Maximizing Your Insurance Coverage

Many of us tend to forget about insurance until we really need it. However, navigating the world of insurance plans may be difficult due to the abundance of accessible insurance kinds and coverage levels.

Making the most of your insurance is crucial if you want to keep your losses from being severe in the event of an emergency. The many types of insurance, how to obtain them, how to completely comprehend your policy, how to choose the appropriate coverage, and how to protect yourself from calamities will all be covered in this blog article. Continue reading to regain financial control and to rest easy knowing that you are completely covered!

What is Insurance?

Insurance is a contract between an individual and an insurance company that provides financial protection against unforeseen losses or damages. The concept of insurance dates back to ancient times when traders would pool their resources to minimize the risk of losing goods while being transported across long distances.

In simple terms, insurance acts as a safety net for individuals in case they face unexpected events such as accidents, illnesses, or natural disasters. By paying premiums regularly, policyholders gain access to coverage that can help them ease their financial burden during tough times.

There are various types of insurance available depending on your needs and requirements. Health insurance covers medical expenses incurred due to illnesses or injuries, car insurance protects you financially if your vehicle gets damaged in an accident, and life insurance provides monetary support for your family members after your demise.

While purchasing an insurance policy may seem like a costly affair at the outset, it is essential for safeguarding yourself from financial harm caused by unforeseen circumstances.

Types of Insurance

Insurance is a contract between the policyholder and the insurance company. It provides financial protection against unexpected events that may cause damage or loss to property, health, or life. There are several types of insurance available in the market to choose from based on individual needs and preferences.

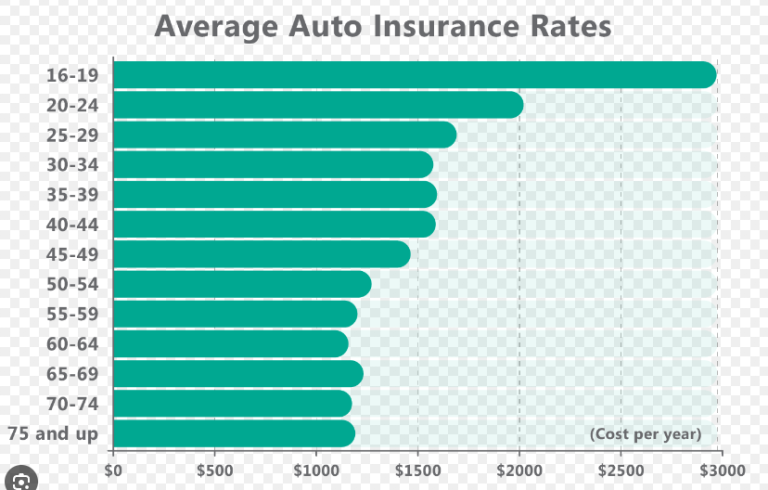

One type of insurance is auto insurance which protects your vehicle against theft, accidents, or damage caused by natural calamities. Health insurance covers medical expenses incurred due to illnesses or accidents.

Homeowners’ insurance helps in safeguarding your home against damages caused by fire, windstorms, lightning strikes, etc. Property insurance is another form of coverage that protects business properties against losses like thefts and other unforeseen events.

Life Insurance provides a lump sum payment when an insured person dies for their beneficiaries. Disability Insurance covers lost income for individuals who can’t work because they’re sick or injured.

There are many different types of insurance with varying levels of coverage that can be purchased depending on individual needs and requirements.

How to Shop for Insurance

When it comes to shopping for insurance, there are a few things you should keep in mind. First and foremost, it’s important to shop around and compare different policies from various providers. Don’t settle for the first policy you come across.

Make sure you understand what each policy covers and the exclusions or limitations that may apply. You don’t want to be caught off guard when filing a claim only to find out your particular situation isn’t covered under your current policy.

Always read reviews and ask for recommendations from friends or family members who have experience with their own insurance coverage. This can help give you an idea of how responsive the company is during claims processes or if they’re notoriously difficult to work with.

Remember that price isn’t everything – while finding affordable coverage is important, it’s equally as crucial to ensure your policy provides adequate protection in case of a catastrophe or disaster.

Understanding Your Policy

Understanding Your Policy:

When it comes to maximizing your insurance coverage, one of the most important things you can do is understand your policy. Insurance policies can be complex and filled with legal jargon that many people may not fully comprehend.

First and foremost, make sure you have a copy of your policy in hand. Take some time to read through it thoroughly, paying attention to any exclusions or limitations that may apply. If there’s anything you’re unsure about, don’t hesitate to reach out to your insurance agent for clarification.

It’s also important to know what type of coverage you have and how much protection it provides. For example, if you have homeowners insurance, does it cover damage caused by natural disasters like floods or earthquakes? Or do you need additional coverage for those types of events?

Another thing to consider is your deductible – the amount you’ll need to pay out-of-pocket before your insurance kicks in. It’s important to choose a deductible that makes sense for your budget but still provides adequate protection.

Keep in mind that policies can change over time – either due to changes in laws or regulations or because the insurer decides to update their offerings. Make sure you stay up-to-date on any changes so that you can adjust accordingly and ensure maximum protection for yourself and your assets.

Choosing the Right Coverage

When it comes to choosing the right insurance coverage, there are many factors to consider. The first step is determining what types of coverage you need based on your lifestyle and potential risks.

For example, if you own a home or vehicle, homeowners and auto insurance are essential. If you have dependents who rely on your income, life insurance can provide financial support in case of unexpected death.

It’s also important to weigh the cost versus benefit of different levels of coverage. While a higher deductible may result in lower monthly premiums, it could leave you with a larger out-of-pocket expense in case of an accident.

In addition to considering your specific needs and budget, research different insurance providers and policies before making a decision. Look for reputable companies with good customer reviews and compare quotes from multiple insurers.

Don’t be afraid to ask questions or seek guidance from an experienced agent when selecting your coverage options. With careful consideration and informed choices, you can maximize your insurance protection while minimizing costs.

Protecting Yourself from Catastrophes

Insurance is essential for safeguarding oneself from unfavorable events. However, in the case of a calamity, even the finest insurance might not be sufficient to completely cover you. It’s crucial to take additional precautions to safeguard your family and belongings as a result.

One of the simplest ways to achieve this is to set up an emergency plan that outlines what to do in the event of an unplanned catastrophe. This should include, among other things, developing an escape strategy and ensuring that everyone is aware of the whereabouts of the crucial documents.

Putting in extra security measures like fire alarms, robber alarms, or even video cameras around your home is another way to keep yourself safe. These can help stop tragedies before they happen or lessen their effects if they do happen.

Also, it’s important to keep important systems like pipes, electricity wires, heating and cooling systems, and more in good shape. Updating these systems makes sure that they work right when you need them the most.

We usually only think of natural disasters like storms and tornadoes when we hear the word “catastrophe.” But accidents can happen anywhere and at any time, so making sure you are safe should always be your first goal. Simple things like buckling up in the car and not texting while walking down the street could save lives in the long run.

You can limit damage tomorrow by being proactive and taking simple but effective safety measures today.

Conclusion

It takes careful planning and consideration to maximize your insurance advantages. It’s critical to understand the many types of insurance available and how they might support you in the event of an emergency. When searching for insurance, conduct your research, evaluate quotes, and consult experts.

Once you’ve selected a policy that meets your needs, it’s critical to monitor it and make any required adjustments as your life evolves. It is necessary to take precautions against potential calamities, such as natural catastrophes or wrecks, in order to ensure that you have complete coverage.

You can be sure that you’re making smart choices about your insurance plans and keeping your money safe by keeping these tips in mind. Don’t wait—start looking over your rules right away!